Topics on this page: CMS Medicaid Budget Overview | CMS Medicaid Services | How Medicaid Works | Recent Program Developments | 2016 Legislative Proposals | Strengthen Cost-Effectiveness of Medicaid | Legislative Proposals for Medicare-Medicaid Enrollees | Multi-Agency Proposals | FY 2016 Medicaid Legislative Proposals

Centers for Medicare & Medicaid Services (CMS): Medicaid

The Centers for Medicare & Medicaid Services ensures availability of effective, up-to-date health care coverage and promotes quality care for beneficiaries.

CMS Medicaid Budget Overview

(Dollars in millions)

| Current Law | 2014 | 2015 | 2016 | 2016 +/- 2015 |

|---|---|---|---|---|

| Benefits /1 | 286,284 | 309,373 | 326,680 | +17,307 |

| State Administration | 15,188 | 19,222 | 17,767 | -1,455 |

| Total Net Outlays, Current Law | 301,472 | 328,595 | 344,447 | +15,852 |

| Proposed Law | 2014 | 2015 | 2016 | 2016 +/- 2015 |

|---|---|---|---|---|

| Legislative Proposals /2 | — | 4,485 | 6,617 | +2,132 |

| Extend Qualified Individual (QI) Program /3 | — | +370 | +775 | +405 |

| Adjustment for QI Transfer from Medicare /3 | — | -370 | -775 | -405 |

| Total Net Outlays, Proposed Law | 301,472 | 333,080 | 351,064 | +17,984 |

| Investment Impact | 2014 | 2015 | 2016 | 2016 +/- 2015 |

|---|---|---|---|---|

| Impacts of Program Integrity Investments /4 | — | — | -59 | -59 |

| Total Net Outlays, Proposed Policy | 301,472 | 333,080 | 351,005 | +17,925 |

Table Footnotes

1/ Includes outlays from the Vaccines for Children Program, administered by the Centers for Disease Control and Prevention.

2/ Includes a proposal to extend Transitional Medical Assistance currently authorized through March 31, 2015; excludes program integrity investments other than those for Medicaid Fraud Control Units.

3/ States pay the Medicare Part B premium costs for Qualified Individuals (QIs) that are in turn offset by a 100 percent reimbursement from Medicare Part B. Costs of the proposal to extend the QI program through CY 2016 are reflected in Medicare outlays. The QI program is currently authorized through March 31, 2015.

4/ Includes the net impact of the HHS and Social Security Administration program integrity investments on the Medicaid baseline.

CMS Medicaid Services

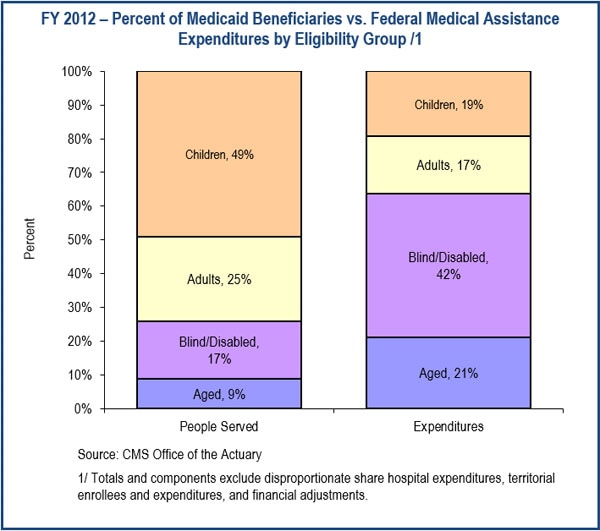

Medicaid is the primary source of medical assistance for millions of low income and disabled Americans, providing health coverage to many of those who would otherwise be unable to obtain health insurance. In FY 2013, more than 1 in 5 individuals were enrolled in Medicaid for at least 1 month during the year, and in FY 2015, nearly 69 million people on average will receive health care coverage through Medicaid.

Growth in per-enrollee Medicaid costs has been historically low in recent years. Specifically, Medicaid spending per enrollee grew by only 1.0 percent annually between 2007 and 2013, compared to 3.2 percent annual growth in per capita national health expenditures over the same time period.1

How Medicaid Works

Medicaid Enrollment

(person-years in millions)

| Enrollees | 2013 | 2014 | 2015 | 2015 +/- 2014 |

|---|---|---|---|---|

| Age 65 and Over | 5.2 | 5.4 | 5.5 | +0.2 |

| Blind and Disabled | 9.7 | 9.8 | 9.8 | — |

| Children | 28.3 | 29.5 | 30.8 | +1.3 |

| Adults | 14.8 | 19.2 | 24.0 | +4.8 |

| Territories | 1.0 | 1.0 | 1.0 | — |

| Total | 59.1 | 64.9 | 71.2 | +6.3 |

Source: CMS Office of Actuary estimates.

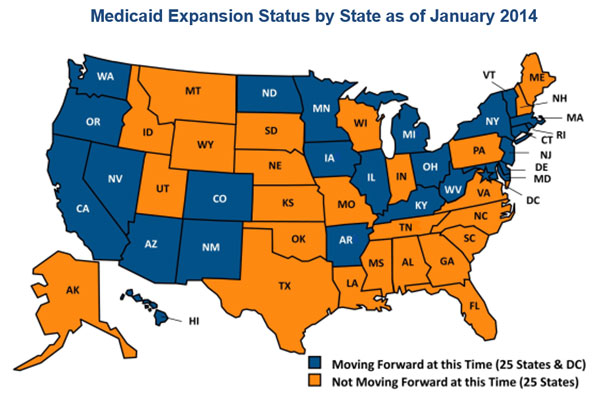

Although the federal government establishes general guidelines for the program, states design, implement, and administer their own Medicaid programs. The federal government matches state expenditures on medical assistance based on the federal medical assistance percentage, which can be no lower than 50 percent. In FY 2016, the federal share of current law Medicaid outlays is expected to be approximately $344.4 billion. States are required to cover individuals who meet certain minimum categorical and financial eligibility standards. Medicaid beneficiaries include children, pregnant women, adults in families with dependent children, the aged, blind, and/or disabled, and individuals who meet certain minimum income eligibility criteria that vary by category. States also have the flexibility to extend coverage to higher income groups, including medically needy individuals through waivers and amended state plans. Medically needy individuals are those individuals who do not meet the income standards of the categorical eligibility groups, but incur large medical expenses such that when subtracted from their income, they fall within the financial eligibility standards.

Under Medicaid, states must cover certain medical services and are provided the flexibility to offer additional benefits to beneficiaries. Medicaid has a major responsibility for providing long term care services because Medicare and private health insurance often furnish only limited coverage of these benefits.

Recent Program Developments

Although the federal government establishes general guidelines for the program, states design, implement, and administer their own Medicaid programs. The federal government matches state expenditures on medical assistance based on the federal medical assistance percentage, which can be no lower than 50 percent. In FY 2016, the federal share of current law Medicaid outlays is expected to be approximately $344.4 billion. States are required to cover individuals who meet certain minimum categorical and financial eligibility standards. Medicaid beneficiaries include children, pregnant women, adults in families with dependent children, the aged, blind, and/or disabled, and individuals who meet certain minimum income eligibility criteria that vary by category. States also have the flexibility to extend coverage to higher income groups, including medically needy individuals through waivers and amended state plans. Medically needy individuals are those individuals who do not meet the income standards of the categorical eligibility groups, but incur large medical expenses such that when subtracted from their income, they fall within the financial eligibility standards.

Under Medicaid, states must cover certain medical services and are provided the flexibility to offer additional benefits to beneficiaries. Medicaid has a major responsibility for providing long‑term care services because Medicare and private health insurance often furnish only limited coverage of these benefits.

2016 Legislative Proposals

The FY 2016 Budget includes a package of legislative proposals with a net impact to the Federal government of $3.7 billion2, including $26.7 billion in Medicaid program investments over 10 years by improving benefits and facilitating coverage for Medicaid beneficiaries while also strengthening the cost-effectiveness of Medicaid. The Budget also includes proposals that impact those who are dually eligible for both Medicare and Medicaid.

Improve Benefits and Facilitate Coverage for Medicaid Beneficiaries

Require Full Coverage of Preventive Health and Tobacco Cessation Services for Adults in Traditional Medicaid: The Budget would require coverage of preventive health services as defined in section 2713 of the Public Health Service Act without cost-sharing for all adults enrolled in the Medicaid program, and also expand section 4107 of the Affordable Care Act, which provides tobacco cessation services (including counseling) to pregnant women, to all Medicaid eligible populations. Such services are already required for most other populations without cost sharing, including individuals in private health plans, the Medicaid expansion population, and various other Medicaid beneficiaries. [$754 million in costs over 10 years]

Create State Option to Provide 12-Month Continuous Medicaid Eligibility for Adults: Currently, individuals enrolled in Medicaid are required to report changes in income, assets, or other life circumstances that may affect eligibility between regularly scheduled redeterminations. This proposal would create a state plan option to allow 12 months of continuous eligibility for individuals who would otherwise be at risk of moving between insurance coverage, often referred to as churning, that disrupts existing provider relationships or increasing the odds of becoming uninsured. States already have a state plan option for continuous eligibility for children in Medicaid and CHIP and that authority would be broadened to include all adults or, at state option, only adults determined eligible for Medicaid on the basis of Modified Adjusted Gross Income. [$4.7 billion in net federal costs including $27.7 billion in Medicaid costs over 10 years]

Extend the Medicaid Primary Care Payment Increase through CY 2016 and Include Additional Providers: Effective for dates of service provided on January 1, 2013 through December 31, 2014, states were required to reimburse qualified providers at the rate that would be paid for the primary care service under Medicare. The federal government covered 100 percent of the difference between the Medicaid and Medicare payment rate. This increased payment rate expired at the end of CY 2014. As part of the Administration’s workforce initiative, this proposal would extend the enhanced rate through December 31, 2016, expand eligibility to obstetricians, gynecologists, and non‑physician practitioners, including physician assistants and nurse practitioners, and exclude emergency room codes to better target primary care. [$6.3 billion in costs over 10 years]

Pilot Comprehensive Long-Term Care State Plan Option: This eight-year pilot program would create a comprehensive long-term care state plan option for up to five states. Participating states would be authorized to provide home and community-based care at the nursing facility level of care, creating equal access to home and community-based care and nursing facility care. The Secretary would have the discretion to make these pilots permanent at the end of the eight years. This proposal works to end the institutional bias in long-term care and simplify state administration. [$4.1 billion in costs over 10 years]

Allow States to Develop Age-Specific Health Home Programs: The Affordable Care Act includes a provision that allows states to create Health Homes for Medicaid enrollees with chronic conditions. Under a Health Home program, states can develop a comprehensive system of care coordination for the purpose of integrating and coordinating all primary, acute, behavioral health, and long‑term services and supports to treat the whole person. States receive an increased federal match for Health Home services for the first eight quarters of their program. This proposal would allow states to target their Health Home programs by age. Currently, states are required to cover Health Home services for all categorically needy individuals with the specified chronic condition(s), regardless of age. Many states have voiced support for allowing age-specific targeting of their Health Home model to better serve the needs of youth with chronic conditions. [$1 billion in costs over 10 years]

Permanently Extend Express Lane Eligibility Option for Children: The Children’s Health Insurance Program Reauthorization Act (P.L. 111-3) authorized Express Lane Eligibility through FY 2014 under which state Medicaid or CHIP agencies can use another public program’s eligibility findings to streamline eligibility and enrollment into Medicaid or CHIP. The Protecting Access to Medicare Act of 2014 (P.L. 113-93) extended the authorization to use Express Lane Eligibility through September 30, 2015. As of January 1, 2015, 14 states and 1 territory used this authority to partner with programs like the Supplemental Nutrition Assistance Program or Temporary Assistance for Needy Families to identify, enroll, and retain children who are eligible for Medicaid or CHIP. The Budget supports a permanent extension of this tool to aid states in furthering their efforts to enroll Medicaid and CHIP eligible children. [$1.2 billion including $680 million in Medicaid costs over 10 years]

Expand Eligibility for the 1915(i) Home and Community-Based Services State Plan Option: The Budget proposes to update eligibility requirements to increase states’ flexibility in expanding access to home and community-based services under section 1915(i) of the Social Security Act. Under current law, certain non-categorically eligible individuals who meet the needs-based criteria can only qualify for home and community-based services through the 1915(i) state plan option if they are also eligible for home and community-based services through a waiver program. Removing this requirement would reduce administrative burden on states and increase access to home and community-based services for the elderly and individuals with disabilities. [$1.3 billion in costs over 10 years]

Allow Full Medicaid Benefits for Individuals in a Home and Community-Based Services State Plan Option: This proposal would provide states with the option to offer full Medicaid eligibility to medically needy individuals who access home and community-based services through the state plan option under section 1915(i) of the Social Security Act. Under current law, when a state elects to not apply the community income and resource rules for the medically needy, these individuals can only receive 1915(i) services and no other Medicaid services. This option will provide states with more opportunities to support the comprehensive health care needs of individuals with disabilities and the elderly. [$38 million in costs over 10 years]

Allow Pregnant Women Choice of Medicaid Eligibility Category: Pregnant women are categorically eligible for Medicaid if they have income under 133 percent of the Federal Poverty Level, so under current law they are excluded from the new adult Medicaid expansion group. Because the benefits and delivery system may differ between the pregnant women and the new adult groups in states that elect to expand, women enrolled in the new adult group who become pregnant as well as postpartum women may have to change providers which would disrupt continuity of care. This proposal addresses this concern by allowing pregnant women enrolled in Medicaid to choose the eligibility category most suited to their needs. [No budget impact]

Require Coverage of Early and Periodic Screening, Diagnostic and Treatment Benefit for Children in Inpatient Psychiatric Treatment Facilities:

While Medicaid coverage is available for children and young adults under age 21 receiving inpatient psychiatric services, they are excluded from coverage of comprehensive preventive and medically necessary items and services to which Medicaid enrolled children are otherwise entitled. This proposal would lift the federal Medicaid exclusion of comprehensive children’s coverage to reduce the financial burden on states and Medicaid families and encourage the provision of critical mental health services to children in Medicaid. [$425 million in costs over 10 years]

Provide Home and Community-Based Waiver Services to Children Eligible for Psychiatric Residential Treatment Facilities: This proposal would provide states with additional tools to manage their children’s mental health care service delivery systems by expanding the non-institutional options available to these Medicaid beneficiaries. By adding psychiatric residential treatment facilities to the list of qualified inpatient facilities, this proposal provides access to home and community-based waiver services for children and youth in Medicaid who are currently institutionalized and/or meet the institutional level of care. Without this change to provisions in the Social Security Act, children and youth who meet this institutional level of care do not have the choice to receive home and community-based waiver services and can only receive care in an institutional setting where residents are eligible for Medicaid. This proposal builds upon findings from the five year Community Alternatives to Psychiatric Residential Treatment Facilities Demonstration Grant Program authorized in the Deficit Reduction Act of 2005 that showed improved overall outcomes in mental health and social support for participants with average cost savings of $36,500–$40,000 per year per participant. [$1.6 billion in costs over 10 years]

Expand State Flexibility to Provide Benchmark Benefit Packages: States currently have the option to provide certain populations with alternative benefit packages called benchmark or benchmark-equivalent plans. This proposal provides states the flexibility to allow benchmark equivalent benefit coverage for non-elderly, non-disabled adults with income that exceeds 133 percent of the federal poverty level. [No budget impact]

Extend Transitional Medical Assistance through CY 2016: The Transitional Medical Assistance program extends Medicaid coverage for at least 6 months and up to 12 months for low income families who lose cash assistance due to an increase in earned income or hours of employment. This proposal extends the Transitional Medical Assistance program through December 31, 2016. This proposal would allow determination of eligibility for Transitional Medical Assistance to be calculated using Modified Adjusted Growth Income to be consistent with the Affordable Care Act. States that adopt the Medicaid expansion will be able to opt out of Transitional Medical Assistance, consistent with a related Medicaid and CHIP Payment and Access Commission recommendation. Current law extends this program through March 31, 2015. [$1.8 billion in costs over 10 years]

Extend the Qualified Individual Program through CY 2016: The Qualified Individual program provides states 100 percent federal funding to pay the Medicare Part B premiums of low income Medicare beneficiaries with incomes between 120 and 135 percent of the Federal Poverty Level. This proposal extends authorization and funding of the program through December 31, 2016. Current law extends this program through March 31, 2015. [$975 million in costs over 10 years]

Expand Eligibility Under the Community First Choice Option: This proposal would provide states with the option to make medical assistance available to individuals who would be eligible under the state plan if they were in a nursing facility. Under current law, any state interested in the Community First Choice Option must create or maintain a 1915(c) waiver with at least one waiver service to make the benefit available to the special income group or provide eligibility for the Community First Choice benefit through another eligibility pathway. This approach is administratively burdensome for states. This proposal would provide equal access to services under the state plan option and provide states with additional tools to manage their long-term care home and community-based service delivery systems. [$3.6 billion in costs over 10 years]

Strengthen Cost-Effectiveness of Medicaid

Rebase Future Medicaid Disproportionate Share Hospital Allotments: As the number of uninsured individuals decreases due to the coverage expansions in the Affordable Care Act, uncompensated care costs for hospitals will also decrease, reducing the level of Disproportionate Share Hospital funding needed. Legislation has extended and revised aggregate Disproportionate Share Hospital funding reductions through FY 2024, but in FY 2025, allotments revert to levels that had been in effect prior to the Affordable Care Act. This proposal would determine future allotments based on states’ actual prior year allotments as reduced by the Affordable Care Act and subsequent legislation. [$3.3 billion in savings over 10 years]

Limit Medicaid Reimbursement of Durable Medical Equipment Based on Medicare Rates: Through the Durable Medical Equipment Competitive Bidding Program, Medicare is in the process of implementing innovative ways to increase efficiency for durable medical equipment payments. These efforts are expected to save Medicare more than $30.2 billion over 10 years. This proposal extends some of these efficiencies to Medicaid by limiting federal reimbursement for a state’s Medicaid spending on certain durable medical equipment to what Medicare would have paid in the same state for the same services. [$4.3 billion in savings over 10 years]

Lower Medicaid Drug Costs and Strengthen the Medicaid Drug Rebate Program: The Budget includes targeted policies to lower drug costs in Medicaid. First, the Budget strengthens the Medicaid Drug Rebate Program by clarifying the definition of brand drugs, collecting an additional rebate for generic drugs whose prices grow faster than inflation, and clarifying the inclusion of certain prenatal vitamins and fluorides in the rebate program. The Budget also corrects a technical error to the Affordable Care Act alternative rebate for new drug formulations, limits to twelve quarters the timeframe for which manufacturers can dispute drug rebate amounts, and excludes authorized generic drugs from average manufacturer price calculations for determining manufacturer rebate obligations for brand drugs. Additionally, the Budget improves Medicaid drug pricing by calculating Medicaid Federal Upper Limits based only on generic drug prices. Finally, the Budget would exempt emergency drug supply programs from the Medicaid rebate calculations. [$6.3 billion in savings over 10 years]

Promote Program Integrity for Medicaid Drug Coverage: The Budget would enhance program integrity for the Medicaid prescription drug program in four ways. First, the Budget would require manufacturers to pay states back for drugs in cases where the manufacturer has either improperly reported non-drug products to CMS or has reported drugs that the FDA has found to be less than effective. Second, the Budget would enhance existing enforcement of manufacturer compliance with drug rebate requirements by allowing more regular audits and surveys of drug manufacturers where cost effective. Third, the Budget would require drugs to be electronically listed with FDA in order for them to be included in Medicaid coverage, thereby aligning Medicaid drug coverage requirements with Medicare drug coverage requirements. Finally, the Budget would increase penalties for fraudulent noncompliance on rebate agreements—particularly where drug manufacturers knowingly report false information under their drug rebate agreements. [$10 million in savings over 10 years]

Increase Access to and Transparency of Medicaid Drug Pricing Data: The Deficit Reduction Act of 2005 (P.L. 109-171) provided funding for this survey which expired in FY 2010. This proposal fully funds a nationwide retail pharmacy survey incorporating prices paid by cash-paying, third-party insured, and Medicaid insured consumers. The funding also permits collection of the actual invoice prices from retail community pharmacies to enable states to set reasonable payment rates to pharmacies. Finally, these proposals provide CMS the authority to collect wholesale acquisition costs for all Medicaid covered drugs. [$30 million in costs over 10 years]

Reduce Fraud, Waste, and Abuse in Medicaid: The Budget includes a number of Medicaid program integrity proposals that strengthen the Department’s and states’ ability to fight fraud, waste, and abuse in the Medicaid program. See the Program Integrity chapter for proposal descriptions. [$700 million in savings over 10 years]

Legislative Proposals for Medicare-Medicaid Enrollees

The Budget includes four proposals to improve the quality and efficiency of care for Medicare-Medicaid, dually-eligible beneficiaries.

Allow for Federal/State Coordinated Review of Dual Special Need Plan Marketing Materials: This proposal would introduce flexibility to rules around the review of marketing materials provided by Dual Special Needs Plans to beneficiaries. Under existing statute, all marketing materials provided by the plans to beneficiaries must be reviewed by CMS staff for accuracy, content, and other stated requirements. Because the plans also market to Medicaid beneficiaries, many of the same marketing materials must also go through a separate review from a state Medicaid agency for compliance with a different set of rules and regulations. Providing CMS with the ability to perform coordinated reviews of these marketing materials for compatibility with a unified set of standards will reduce the burden on CMS and the states, while also potentially improving the quality of the products available to beneficiaries. [No budget impact]

Create Pilot to Expand PACE Eligibility to Individuals between Ages 21 and 55: This program provides comprehensive long‑term services and supports to Medicaid and Medicare beneficiaries through an interdisciplinary team of health professionals who provide coordinated care to beneficiaries in the community. For most participants, the comprehensive service package includes medical and social services and enables them to receive care in the community rather than to receive care in a nursing home or other facility. Under current law, the program is limited to individuals who are 55 years old or older and who meet, among other requirements, the state’s nursing facility level of care. This proposal would create a pilot demonstration in selected states to expand eligibility to qualifying individuals between 21 years and 55 years of age. This effort would test whether the Program for All-Inclusive Care for the Elderly can effectively serve a younger population without increasing costs. The pilot would promote access to community services in line with the integration of the landmark Olmstead Supreme Court decision3; supporting self-determination and achieving better health outcomes. [No budget impact]

Ensure Retroactive Part D Coverage of Newly Eligible Low-Income Beneficiaries: This proposal would allow CMS to contract with a single plan to provide Part D coverage to low income beneficiaries while their eligibility is processed. This plan would serve as the single point of contact for beneficiaries seeking reimbursement for retroactive claims. These beneficiaries are assigned at random under current law to a qualifying Part D plan, which is reimbursed based on the standard Part D prospective payment, regardless of their utilization of Part D services during this period. Under this proposal, the plan would be paid using an alternative methodology whereby payments are closer to actual costs incurred by beneficiaries during this period. A current demonstration, which was recently extended through 2019, has shown the proposed approach to be more efficient and less disruptive to beneficiaries. [No budget impact]

Integrate the Appeals Process for Medicare-Medicaid Enrollees: Medicare and Medicaid have different appeals processes governed by different provisions of the Social Security Act, resulting in different requirements related to timeframes and limits, amounts in controversy, and levels of appeals. At times, these requirements may conflict and can result in confusion for beneficiaries and inefficiencies and administrative burdens for states and providers. This proposal provides authority for the Secretary to implement a streamlined appeals process to more efficiently integrate Medicare and Medicaid program rules and requirements, while maintaining the important beneficiary protections included in both programs. [No budget impact]

Multi-Agency Proposals

Establish Hold Harmless for Federal Poverty Guidelines: To protect access to programs, including Medicaid, for low income families and individuals, this proposal would treat the Consumer Price Index for All Urban Consumers adjustment for the poverty guidelines consistent with the treatment of the annual cost of living adjustments for Social Security Benefits. The poverty guidelines would only be adjusted when there is an increase in the Index, not a decrease. [No budget impact.

Extension of Enhanced Medicaid Matching Funds for Upgrading and Integrating Eligibility and Enrollment Systems

In October 2014, CMS announced its intention to promulgate regulations to permanently extend the enhanced Federal matching rate for eligibility and enrollment systems modernization. The increase is scheduled to expire on December 31, 2015 which would decrease the federal matching rate from 90 percent to 50 percent, thereby increasing the cost to states. Through December 2014, under the enhanced match, CMS has approved $4.7 billion for states to enhance their systems in order to incorporate the new Affordable Care Act eligibility criteria and create a streamlined and automated consumer experience. Some elements of this successful strategy include pre-populated online renewal forms, real time eligibility determinations, and integration of Medicaid, CHIP, and Marketplace enrollment decisions and notifications. As a condition of the extension, CMS will propose states meet new criteria including completing Modified Adjusted Gross Income based system functionality and incorporating best practices for systems development and management. In addition, to support the integration of eligibility systems between Medicaid and human services programs, such as Supplemental Nutrition Assistance Program and Temporary Assistance for Needy Families, the Federal government extended a waiver of cost allocation requirements set forth in OMB Circular A87 for three additional years, through December 2018.

FY 2016 Medicaid Legislative Proposals

Dollars in millions

(negative numbers reflect savings and positive numbers reflect costs)

| Improve Benefits and Facilitate Coverage for Medicaid Beneficiaries | 2016 | 2016 -2020 |

2016 -2025 |

|---|---|---|---|

| Require Full Coverage of Preventive Health and Tobacco Cessation Services for Adults in Traditional Medicaid | 95 | 431 | 754 |

| Create State Option to Provide 12-Month Continuous Medicaid Eligibility for Adults (non-add) /1 | 299 | 1,844 | 4,713 |

| Medicaid Impact | 600 | 10,200 | 27,700 |

| Marketplace Subsidies and Related Impacts (non-add) | -301 | -8,152 | -22,987 |

| Extend the Medicaid Primary Care Payment Increase through CY 2016 and Include Additional Providers | 5,010 | 6,290 | 6,290 |

| Pilot Comprehensive Long-term Care State Plan Option | 0 | 2,345 | 4,085 |

| Allow States to Develop Age-Specific Health Home Programs | 200 | 570 | 1,010 |

| Permanently Extend Express Lane Eligibility Option for Children (non-add) /2 | 30 | 465 | 1,170 |

| Medicaid Impact | 20 | 215 | 680 |

| CHIP Impact (non-add) | 10 | 250 | 490 |

| Expand Eligibility for the 1915(i) Homes and Community-Based Services State Plan Option | 26 | 439 | 1,341 |

| Allow Full Medicaid Benefits to All Individuals in a Home and Community Based Services State Plan Option | 1 | 15 | 38 |

| Allow Pregnant Women Choice of Medicaid Eligibility Category | — | — | — |

| Require Coverage of Early and Periodic Screening, Diagnostic, and Treatment for Children in Inpatient Psychiatric Treatment Facilities | 30 | 180 | 425 |

| Provide Home and Community-Based Waiver Services to Children Eligible for Psychiatric Residential Treatment Facilities | 0 | 597 | 1,625 |

| Expand State Flexibility to Provide Benchmark Benefit Packages | — | — | — |

| Extend the Transitional Medical Assistance Program through CY 2016 /3 | 1,075 | 1,825 | 1,825 |

| Extend the Qualified Individual Program through CY 2016 /4 | 775 | 975 | 975 |

| Adjustment for Qualified Individuals Transfer from Medicare /4 | -775 | -975 | -975 |

| Expand Eligibility Under the Community First Choice Option | 238 | 1,451 | 3,581 |

| Strengthen Cost-Effectiveness of Medicaid | 2016 | 2016 -2020 |

2016 -2025 |

|---|---|---|---|

| Rebase Future Medicaid Disproportionate Share Hospital Allotments | 0 | 0 | -3,290 |

| Limit Medicaid Reimbursement of Durable Medical Equipment Based on Medicare Rates | -305 | -1,780 | -4,270 |

| Lower Medicaid Drug Costs and Strengthen the Medicaid Drug Rebate Program | -276 | -2,543 | -6,325 |

| Clarify the Medicaid Definition of Brand Drugs (non-add) | -16 | -78 | -160 |

| Apply Inflation-Associated Penalty to Medicaid Rebates for Generic Drugs (non-add) | — | -145 | -1,165 |

| Require Coverage of Prescribed Prenatal Vitamins and Fluorides under the Medicaid Drug Rebate Program (non-add) | — | — | — |

| Correct the ACA Medicaid Rebate Formula for New Drug Formulations (non-add) | -210 | -1,890 | -4,020 |

| Limit Dispute Resolution Timeframe in the Medicaid Drug Rebate Program to Twelve Quarters (non-add) | — | — | — |

| Exclude Authorized Generics from Medicaid Brand-Name Rebate Calculations (non-add) | -20 | -100 | -200 |

| Exclude Brand and Authorized Generic Drug Prices from the Medicaid Federal Upper Limits (FUL) (non-add) | -30 | -330 | -780 |

| Exempt Emergency Drug Supply Programs from Medicaid Drug Rebate Calculation (non-add) | — | — | — |

| Promote Program Integrity for Medicaid Drug Coverage | -1 | -5 | -10 |

| Require Manufacturers that Improperly Report Items for Medicaid Drug Coverage to Fully Repay States (non-add) | -1 | -5 | -10 |

| Enforce Manufacturer Compliance with Drug Rebate Requirements (non-add) | — | — | — |

| Require Drugs be Electronically Listed with the Food and Drug Administration to Receive Medicaid Coverage (non-add) | — | — | — |

| Increase Penalties for Fraudulent Noncompliance on Rebate Agreements (non-add) | — | — | — |

| Increase Access to and Transparency of Medicaid Drug Pricing Data | 6 | 30 | 30 |

| Provide Continued Funding for Survey of Retail Pharmacy Prices (non-add) | 6 | 30 | 30 |

| Require Drug Wholesalers to Report Wholesale Acquisition Costs to CMS (non-add) | — | — | — |

| Reduce Fraud, Waste, and Abuse in Medicaid /5 | -19 | -305 | -700 |

| Total Outlays, Medicaid Proposals | 3,350 | 19,955 | 34,789 |

| Medicare-Medicaid Enrollee Proposals | 2016 | 2016 -2020 |

2016 -2025 |

|---|---|---|---|

| Allow for Federal/State Coordinated Review of Dual Special Need Plan Marketing Materials | — | — | — |

| Create Pilot to Expand PACE Eligibility to Individuals Between Ages 21 and 55 | — | — | — |

| Ensure Retroactive Part D Coverage of Newly Eligible Low-Income Beneficiaries | — | — | — |

| Integrate Appeals Process for Medicare-Medicaid Enrollees | — | — | — |

| Total Outlays, Medicare-Medicaid Enrollee Proposals | — | — | — |

| Medicaid Interactions | 2016 | 2016 -2020 |

2016 -2025 |

|---|---|---|---|

| Extend CHIP Funding through FY 2019 /6 | -100 | -7,300 | -7,300 |

| Establish Hold-Harmless for Federal Poverty Guidelines | — | — | — |

| Create Demonstration to Address Over-Prescription of Psychotropic Medications for Foster Care Children /7 | 114 | 608 | 552 |

| Extend Special Immigrant Visa Program /8 | 12 | 66 | 121 |

| Extend Supplemental Security Income Time Limits for Qualified Refugees /9 | 10 | 22 | 22 |

| Modernize Child Support /10 | 0 | 32 | 130 |

| Modify Length of Exclusivity to Facilitate Faster Development of Generic Biologics /11 | 0 | -30 | -130 |

| Prohibit Brand and Generic Drug Manufacturers from Delaying the Availability of New Generic Drugs and Biologics /11 | -120 | -640 | -1,450 |

| Total Outlays, Medicaid Interactions | -84 | -7,242 | -8,055 |

| Total Outlays, Medicaid Legislative Proposals | 2016 | 2016 -2020 |

2016 -2025 |

| Total Outlays, Medicaid Legislative Proposals | 6,617 | 12,713 | 26,734 |

| Total Outlays, Total Federal Impact /12 | 6,315 | 4,561 | 3,747 |

Legislative Proposals Tables Footnotes

1/ The score reflects the impact on Medicaid, other HHS programs, and U.S. Department of Treasury programs and accounts.

2/ The score reflects the impact on both Medicaid and the Children's Health Insurance Program.

3/ Currently authorized through March 31, 2015.

4/ States pay the Medicare Part B premium costs for Qualified Individuals (QIs) that are in turn offset by a reimbursement from Medicare Part B. Costs of the proposal to extend the QI program are reflected in Medicare outlays. The QI program is currently authorized through March 31, 2015.

5/ This includes proposals described in the Program Integrity chapter, excluding savings not subject to PAYGO and excluding the proposal to Expand Funding and Authority for the Medicaid Integrity Program, which is described in the Program Integrity chapter but accounted for in the tables in the State Grants and Demonstrations chapter.

6/ This score reflects the impact on the Medicaid program. Please see the Children’s Health Insurance Program chapter for more information on this proposal.

7/ This is a joint proposal with the Administration for Children and Families (ACF). The score reflects the impact on the Medicaid baseline. Please see the ACF and State Grants and Demonstration chapters for more information on this proposal.

8/ This proposal is included in the State Department's FY 2016 Budget Request.

9/ This proposal is included in the Social Security Administration's FY 2016 Budget Request.

10/ This proposal is included in the Administration for Children and Families FY 2016 Budget Request.

11/ This proposal is a multi-agency proposal with savings to Medicaid. See Medicare chapter for proposal descriptions.

12/ The total Federal impact of this proposal reflects $23 billion in savings to the Marketplace subsidies and related impacts reflected in the Department of Treasury programs and accounts.

Next:

- Overview

- Medicare

- Program Integrity

- Medicaid

- Children’s Health Insurance Program

- State Grants and Demonstrations

- Private Health Insurance Protections and Programs

- Center for Medicare and Medicaid Innovation

- Program Management

1 Hartman, Micah, et al. National Health Spending In 2013: Growth Slows, Remains In Step With The Overall Economy. Journal of Health Affairs. December 2014. http://content.healthaffairs.org/content/34/1/150

2 This includes $23 billion in savings to the Marketplace subsidies and related impacts reflected in the Department of Treasury programs and accounts.

3 The U.S. Supreme Court’s 1999 landmark decision in Olmstead v. L.C. (Olmstead) found the unjustified segregation of people with disabilities is a form of unlawful discrimination under the Americans with Disabilities Act (ADA). Olmstead requires States to administer programs in the most integrated setting appropriate to the needs of qualified individuals with disabilities.